Funding

🌿 Agriconomie - France - EUR 60M - Series B - Online agribusiness marketplace

🌿 Biotic - Israel - EUR 2M - Seed - Developer of a biological polymer designed to offer an optimal alternative for fossil-based plastics

🌿 Traction - US - EUR 3.5M - Seed - Cloud-based farm accounting and management

🌿 Irreo - Italy - EUR 850k - Seed - Sensorless platform for farm irrigation management

🌿 Carbon Re - UK - GBP 4.2M - Seed - AI platform, which enables the cement industry to reduce over CO2 emissions

🌿 Something & Nothing - UK - EUR 2.8M - Seed - Vegan drinks without chemicals, additives, or artificial coloring

🌿 Carble - Netherlands - EUR 300k - Seed - Carbon insetting, financially compensating farmers for preventing deforestation

🌿 Apheris - Germany - EUR 8.7M - Seed - AI-powered collaborative data ecosystems

🌿 ConstellR - Germany - EUR 10M - Early stage - Space-based water monitoring

🌿 MyFeld.ch - Switzerland - Undisclosed - Early stage - fresh farm food platform

🌿 Improvin’ - Sweden - Undisclosed - Early stage - AI-powered platform to measure and report CO2 emissions

🌿 Farmers & Chefs - Sweden - Undisclosed - Early stage - Plant-based products intended to provide cooking products

🌿 Kermap - France - EUR 1.6M - Early stage - AI-based satellite data analysis

🌿 BioRaptor - Israel - $ 3M - Early stage - AI-generated data insights for industrial biotech scale-up process

🌿 Roslin Tech - Scotland - GBP 11M - Series A - Pluripotent animal stem cells with the capacity to self-renew indefinitely and to differentiate into the desired end-tissue for meat

🌿 REEtec (Industrial Chemicals) - Norway - EUR 115.2M - Late stage - Rare earth elements separation technology

🌿 PulPac - Sweden - EUR 31M - Late stage - Dry Molded Fiber tech production

🌿 Do you like what you are reading? Why not share it with your network?

News, Readings & Interesting Things

🌿 Eight lessons from the first climate tech boom and bust by Bessemer Venture Partners.

Avoid relying exclusively on altruism to scale

Innovate on business model to tackle challenging sales motions

Leverage the regulatory environment as an advantageous tailwind

Beware of supply chain shocks

Invest in engineering problems, not science experiments

Be wary of long investment horizons and financing risk at each stage of the company’s lifecycle

Opportunities for better data as IoT and robotic technologies move down the cost curve

Drive value through software that facilitates the deployment and operations of renewable energy assets

🌿 Traction Ag Inc., the first cloud-based accounting software delivering solutions to growers across the Midwest, announced its acquisition of Granular Business, a farm financial management software.

🌿 Sustainability from an investor’s perspective and what it really means.

🌿 Coca-Cola, one of the world's largest plastic polluters, had increased non-recycled plastic use as it prepares to sponsor the COP27 UN climate summit.

Data from the Ellen MacArthur Foundation, which has drawn together a group of multinationals in a “global commitment” to cut plastic waste, show that Coca-Cola, PepsiCo and Walmart were among the worst offenders increasing virgin, non-recycled plastic use in 2021.

🌿 Venture capital funds broke a record - for the largest amount of capital raised ($151bn) in any prior full year. Currently, venture funds possess nearly $300bn of dry powder, unallocated funds.

While the count of new climate funds (65 and 63) was nearly identical between FY’21 and ’22 YTD, the $AUM more than doubled from $30bn FY’21 to $64B ’22 YTD.

Most of the $AUM is concentrated in a few mega funds. ~20% of the count of new funds are >$500m, but control ~80% of the $AUM

Since 2021, 101 climate VC and CVC funds totaling $22bn and 14 Growth Equity and Private Equity funds (“Growth”) totaling $38bn have been announced.

~$6.1B of that new reserved capital has been moved into climate companies since the start of 202,1 which means that there’s at least ~$37.1bn in dry powder

🌿 Appr. 20x capital was invested in new agtech ventures in 2021 than 2012, whereas VC investment in the overall market grew approximately 11x. That said, agtech investment saw a decline toward the end of 2021.

Despite the decline, there are three reasons for optimism:

Agtech funding may be down year-over-year, but it remains historically high and may be stabilizing;

A significant amount of “dry powder” remains in the overall VC market and with non-VC private equity investors;

Food and sustainability remain high-priority areas for a number of investors, particularly those with ESG agendas.

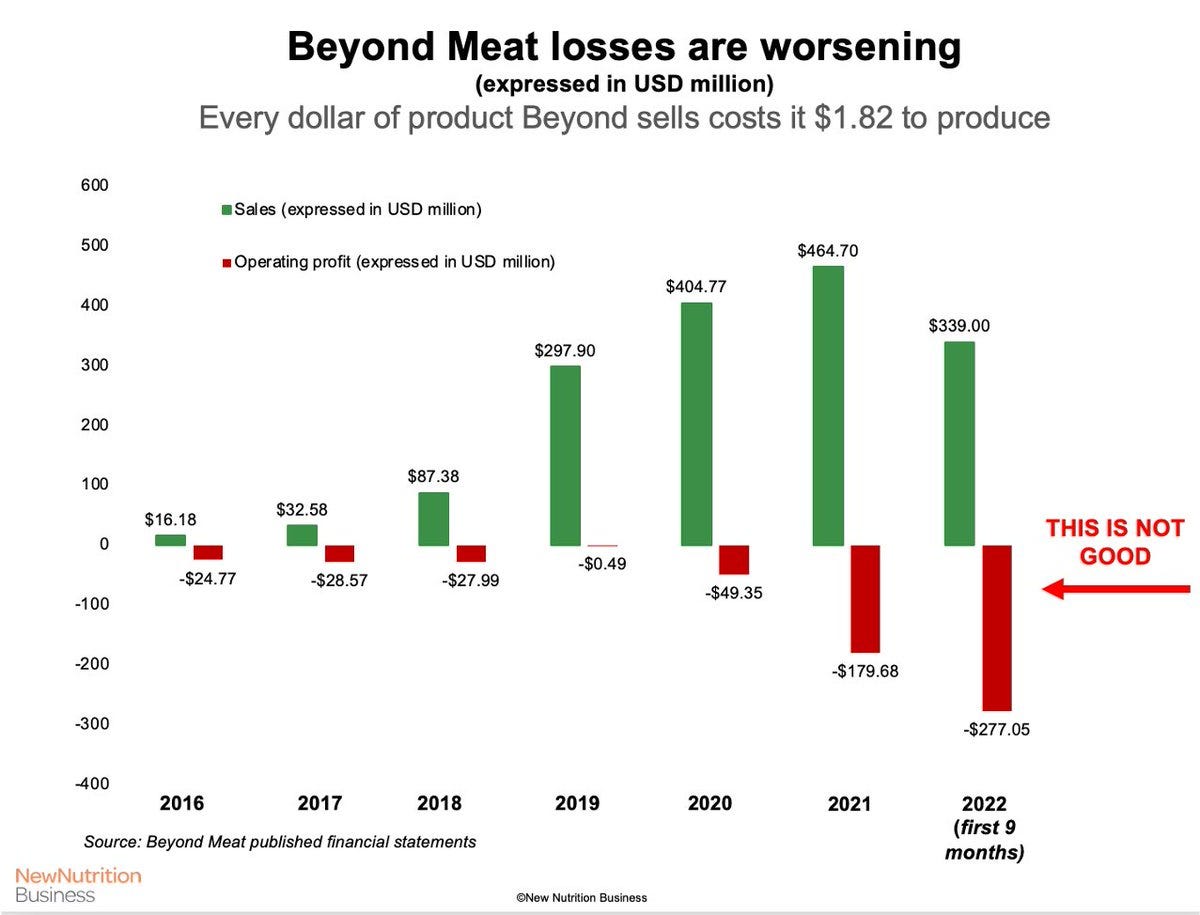

🌿 Plant-based meat manufacturer Beyond Meat has reported a $102 million net loss for the three months ended Oct. 1, while revenue fell to $83 million, down 23% from the year-ago period. Losses up by 180%. Every $1 of product Beyond Meat sells costs $1.82 to make.

The revenue drop comes as the company has cut prices to boost sales during a period of steep food-price inflation and amid what Beyond said was weaker than expected demand.

🌿 As plant and mushroom-based leathers gain favor, the inclusion of synthetic polymers in many of these 'leather alternatives' has prompted the question: how sustainable is vegan leather?

Numerous brand owners and designers raised concerns about byproduct hides not being valued as a long-lasting premium material due to the increased strength, durability, and color fastness required of leather.

Thanks for reading. Reach me with tips, questions, and feedback on Twitter or LinkedIn.

If you enjoy this newsletter, why not share it with your friends and co-workers?

___

The views expressed here are my own. All information contained in here has been obtained from publicly available information. While taken from sources believed to be reliable I have not independently verified such information and make no representations about the enduring accuracy of the information or its appropriateness for a given situation. This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. For questions simply reply to this email.