For decades, the food industry has launched “one-size-fits-all” products and relied on outdated, slow surveys to figure out what people want. That’s changing.

AI, wearables, and neuroscience are shifting how food is created, marketed, and personalised. We’re entering an era where snacks don’t just taste good—they’re built around your biology, your mood, and your unique sensory profile.

If you're working anywhere along the food value chain, this shift is impossible to ignore. A new generation of AI tools is replacing "launch and hope" with smarter, faster, and more personalised development—long before products hit the shelves.

Let’s break down the three most important AI capabilities transforming food-tech today, and where they fit in the value chain:

1. Trend Prediction

Where it fits: Early-stage insights and R&D

Think of it as a crystal ball for emerging tastes and food formats.

What it does:

AI scans billions of data points—TikTok trends, grocery searches, menus, and even recipe photos—to spot patterns before they go mainstream. It doesn't just track what’s trending now, but what will trend six months from now.

It also identifies whitespace opportunities: where flavor combinations or ingredient claims are missing in the current market. For example, discovering that sour yuzu is trending among Gen Z but is still absent in most energy drinks. Or that gut-health claims are exploding in snack bars—but no one has applied them to savory formats yet.

Why it matters:

Gives R&D teams weekly insight reports, not just annual summaries

Reduces guesswork and blind spend on concepts that won’t resonate

Helps marketers and sales teams craft data-backed narratives

Allows faster packaging and branding decisions (e.g., bold fonts and citrus visuals for summer sour trends)

Gives commercial teams credible storytelling tools: “We’re launching this now because our AI shows it’s peaking in Q3”

The edge

This data becomes a proprietary trend graph over time. The more a company feeds in category-specific data, the smarter and more defensible their model gets.

2. Brain & Body Tuning

Where it fits: Product formulation and pilot testing. This is where food starts functioning more like a supplement—or even a wearable.

What it does:

AI analyzes how your body responds to specific recipes using biometric signals—EEG, HRV, glucose monitors, gut microbiome tests, and more. It helps answer questions like:

Which ingredients help with focus?

What combination leads to a more stable blood sugar response?

Can this drink measurably reduce stress?

Rather than relying on consumer claims like “I felt more focused,” the AI quantifies whether a bite or sip produced a measurable effect—like improved mental clarity, lowered cortisol, or a flatter glucose curve.These signals then guide new iterations of the recipe, optimized for physiological effect—not just taste.

Why it matters:

Enables specific, proof-based claims like “clinically shown to sustain focus for 90 minutes”

Creates high-value, proprietary datasets (ingredient → biometric outcome) that are hard for competitors to reverse-engineer

Shortens iteration cycles: instead of launching, waiting, and adjusting, you optimize in the lab

Allows dose precision: e.g., 1.8g of lion’s mane works better than 2.5g for sustained attention, based on continuous data

Expands the use case horizon—products aren’t just tasty, they’re tools for performance, calm, recovery, or hormonal support

Justifies premium pricing for bio-validated foods

Strategic value

These models can replace parts of clinical testing, simulate outcomes before formulation, and create IP-protected “bio-labels” that set products apart on the shelf.

3. Taste Profiling

Where it fits: Personalisation and post-launch targeting

Taste is subjective—AI is making it objective.

What it does:

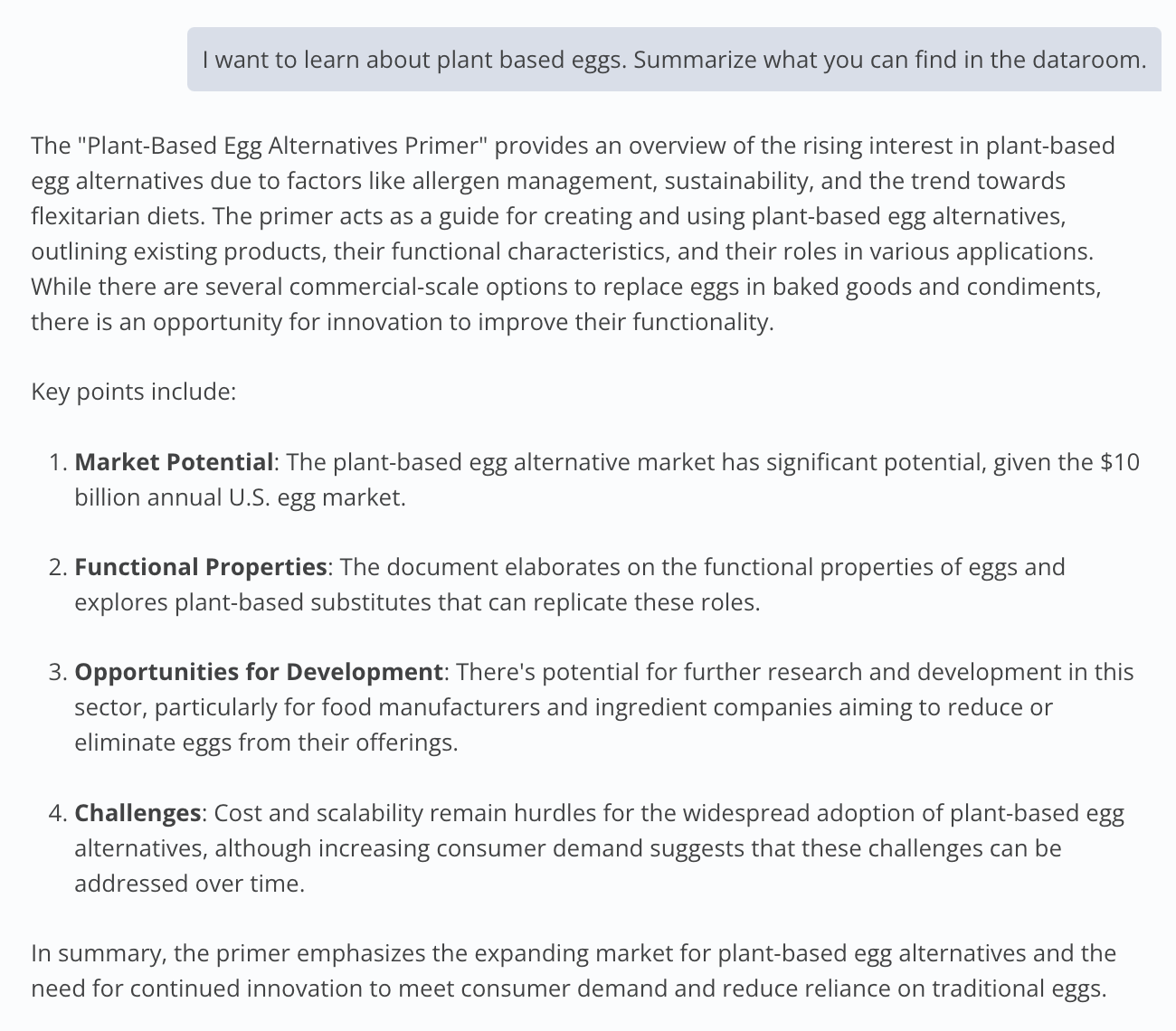

Everyone experiences flavor differently. Taste profiling uses games, micro-surveys, purchase history, and (optional) genetic markers to build a sensory “fingerprint” for each consumer. From that, AI can recommend products with stunning accuracy: “This wine matches your aroma preferences and bitterness tolerance with 92% confidence.”

Over time, as users rate or purchase, their taste vector sharpens. It even enables real-time nudging: “You’re low-energy—this citrus-ginger drink fits your profile and supports focus.”.

Over time, feedback loops back into R&D, sharpening future product design.

Why it matters:

Boosts retention and converts new customers into long-term subscribers: products feel custom-built, not generic

Slashes sampling and return costs—especially in wine, supplements, or premium snacks

Provides brands with a unique dataset (taste → behavior) they own and can’t buy off the shelf

Enables micro-targeting by geography: e.g., Region A loves spice-forward kombucha; Region B prefers floral and sweet

Beyond DTC

Retailers and CPG brands can use this data to optimize store assortments, improve placement, or even dynamically personalize promotions at the shelf or online.

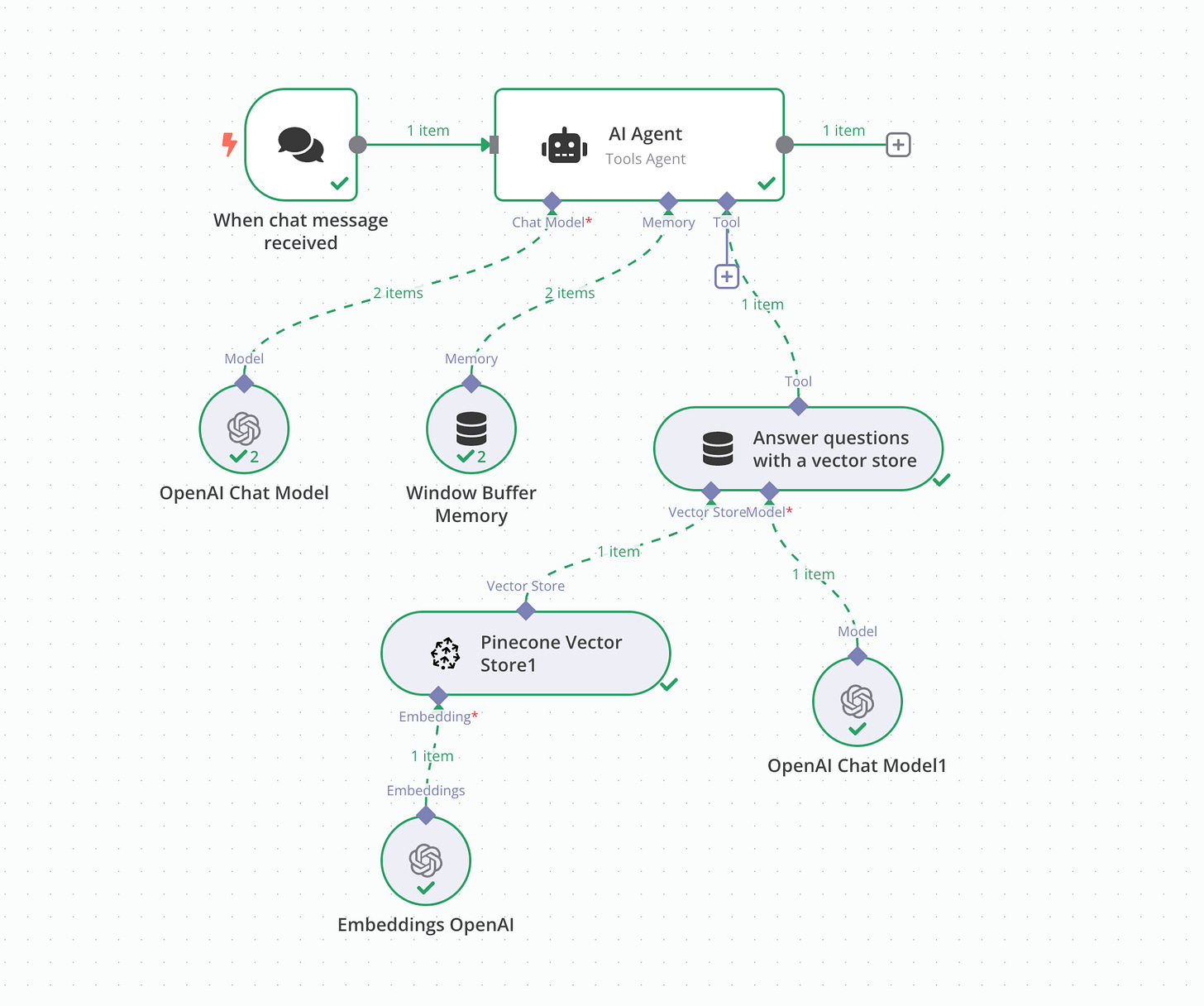

How It All Comes Together: The Virtuous Loop

These three technologies don’t live in isolation. When combined, they create a powerful, compounding loop:

Predict (Trend Engine) : NLP and computer vision models detect new trends—e.g., a spike in yuzu + adaptogens on Gen Z’s social feeds.

Formulate/ Validate: Prototypes are tested using wearables or biometric tools. AI helps identify which version truly delivers the promised benefit—like a better focus window. Trend engine now sees which trend ideas actually work physiologically, rank-ordering future bets by both buzz and biological efficacy.

Personalise: The final product is matched to individual taste profiles, improving satisfaction and retention. Adds live market-fit data: which formulas resonate with which sensory clusters—fuel for more precise trend segmentation

Capture & Loop Back: Real-world feedback—purchase behavior, reviews, biometric responses—is fed back into the system, improving the next cycle. The trend engine re-trains on outcome-weighted data, making its next forecasts not only fashionable but also functionally proven and sensorially verified.

Each turn of the loop sharpens the next, reducing risk and time-to-market while increasing up consumer satisfaction.

For anyone building—or betting on—the next wave of food innovation, mastering these three layers is no longer optional. It’s the playbook for moving from “I hope this sells” to “I already know who will love this and why.”

Why the Loop Compounds Over Time

Data Network Effects

Every consumer interaction adds new labelled datapoints, making subsequent predictions sharper. A rival starting tomorrow can’t simply “match the model”—they lack the historical bio-sensory graph.Shrinking R&D Cycles

Classic CPG cycles run 18–24 months. Firms running this loop see early customers tasting pilot batches within 6–12 weeks, because trend filtering and bio-validation happen almost in parallel.Capital Efficiency

Each “spin” reallocates spend from low-yield shelf tests to high-signal experiments. Dollar for dollar, the model gets smarter, while traditional players keep burning on failed line extensions.

Regulatory & IP Moat

Biometrically backed claims (“reduces post-meal glucose by 22 %”) require proprietary datasets plus statistical models that stand up to regulators. Once filings are in, competitors must build their own loop—or license yours.

A Few Reality Checks

Bias: Early adopters may skew toward affluent, health-tracking users. Continuous, diverse sampling helps keep the model fair.

Org Design: This AI loop isn’t a plug-and-play tool. Teams from R&D, insights, marketing and product need to work from a shared data backbone to fully unlock its value.

Accuracy and Interpretation of Biometric Data: Biometric data from consumer-grade wearables can have variability and may not always be as accurate as clinical-grade measurements. Moreover, interpreting this data correctly and translating it into actionable, safe, and effective nutritional advice is complex.

Regulatory Hurdles & Claim Substantiation: Making specific health claims (e.g., "improves focus") using AI and biometric data faces strict regulatory scrutiny. Substantiating these claims requires robust, scientifically valid data, a potentially lengthy and costly process. The blurring line between "food" and "medical product" adds further regulatory complexity.

Scalability of True Personalization: While AI excels at creating personalized profiles, translating these into truly individualized product formulations and mass-market delivery presents significant operational and supply chain challenges. The vision of unique products for everyone may conflict with mass production realities.

Privacy: Handling biometric and sensory data comes with responsibility. Consent and GDPR-grade data security are essential.

The food industry is at a moment, where AI and biometric insights are transforming product development from an art into a science. By predicting trends, validating effects, and personalizing taste, companies can build a future where food is smarter, more effective, and deeply connected to individual needs.

Thanks for reading. Reach me with tips, questions, and feedback on Twitter or LinkedIn.

If you enjoy this newsletter, why not share it with your friends and co-workers?

The views expressed here are my own. All information contained in here has been obtained from publicly available information. While taken from sources believed to be reliable I have not independently verified such information and make no representations about the enduring accuracy of the information or its appropriateness for a given situation. This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. For questions simply reply to this email.